Inflation has been a major challenge for many people in recent years, including influencers. To add to that, the cost of living has increased significantly, while influencer marketing rates have remained relatively stagnant.

As a result, it’s important for influencers to budget carefully and ensure that their business is profitable.

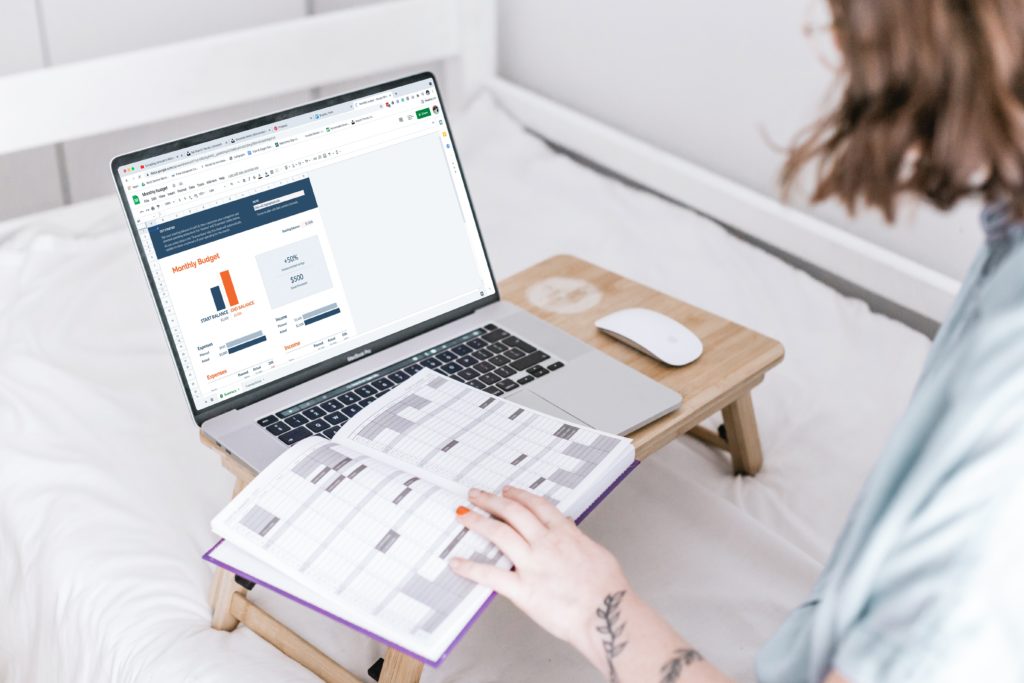

Hence, a financial calculator for budgeting can be a valuable tool for influencers who want to manage their finances effectively. To that point, there are many different budgeting calculators available online, but some of the most popular features include:

- Income tracking: Allows influencers to track their earnings from different sources, such as sponsorships, affiliate marketing, and merchandise sales.

- Expense tracking: Enables influencers to track their spending in different categories, such as business expenses, personal expenses, and savings.

- Budget creation: Permits influencers to create budgets for different time periods, such as monthly, quarterly, and annually.

- Financial forecasting: Helps influencers to forecast their future income and expenses based on historical data and trends.

The Financial Calculator For Budgeting Every Influencer Should Use

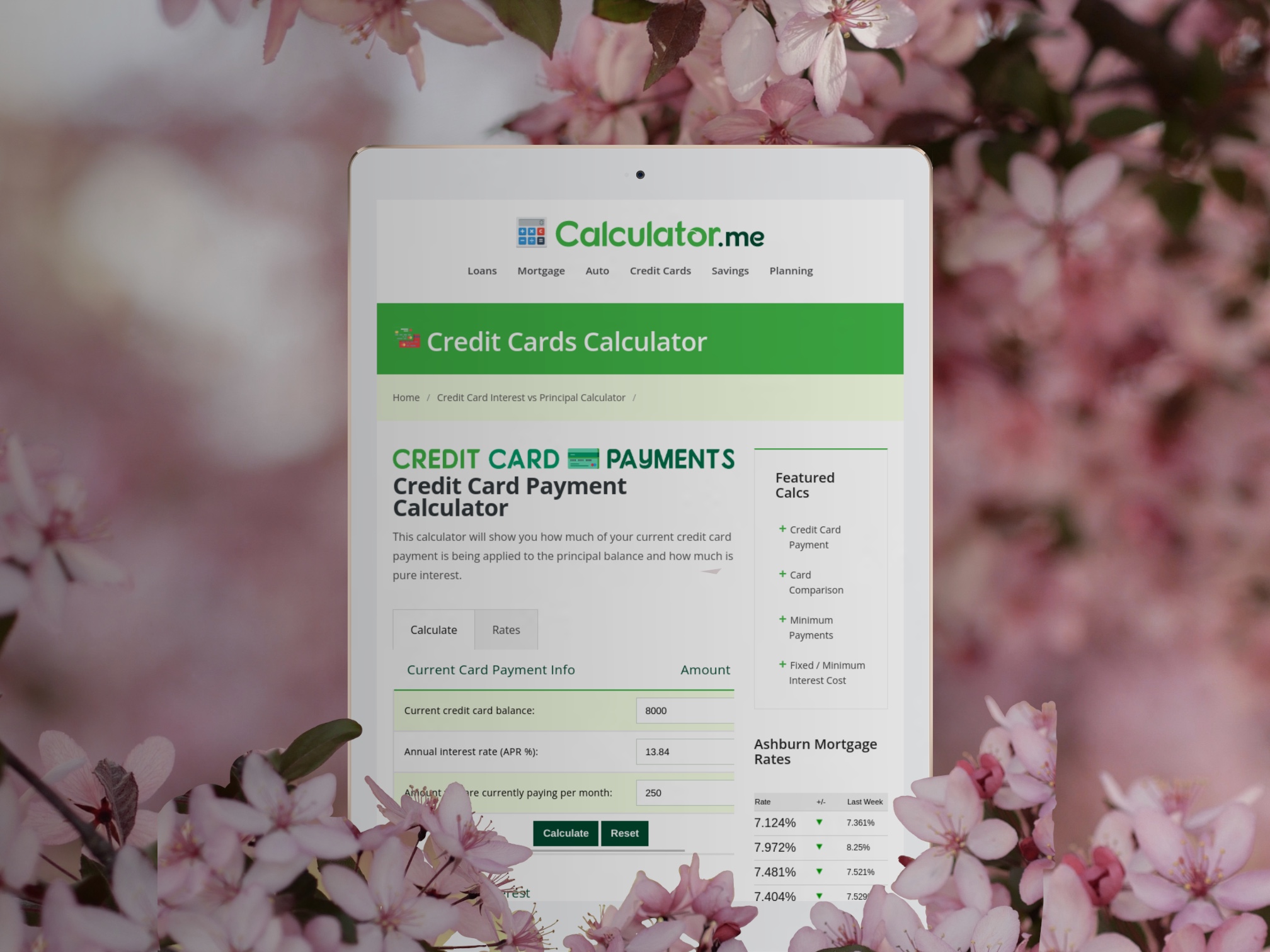

When it comes to which online calculator to use, I’m partial to Calculator.me because it’s straight forward and easy to use. Best of all, you don’t need any financial experience or expertise; all you’re doing is plugging in numbers and watching the magic unfold.

Moreover, I’ve complied a few tips for influencers on how to use a financial calculator for budgeting.

- Start by setting financial goals. What do you want to achieve with your influencer business? Do you have a goal to save a specific amount of money each month? Do you want to invest in new equipment or hire new team members? Once you know your goals, you can use the budgeting calculator to create a plan to achieve them.

- Track your income and expenses carefully. The more accurate your data is, the more accurate your budget will be. Make sure to track all of your income and expenses, even the small ones.

- Create a budget for each time period. This will help you to stay on track and make sure that you are not overspending.

- Review your budget regularly. Truth is, your financial situation isn’t permanent and over time, it can change, therefore, it’s critical to review your budget regularly and make adjustments accordingly.

Additionally, listed below are some specific examples of how you can use a financial calculator for budgeting:

- Estimate monthly earnings. Influencers can use the budgeting calculator to estimate their monthly earnings based on their current sponsorship rates and engagement metrics. This helps you create a realistic budget and avoid overspending.

- Plan for seasonal fluctuations. Realistically, influencer marketing earnings can fluctuate seasonally. For example, an influencer in the fashion industry may earn more during the holiday season. The budgeting calculator can help influencers to plan for these fluctuations and ensure that they have enough savings to cover their expenses during lean months.

- Set aside money for taxes and self-employment taxes. As an influencer, you are responsible for paying your own taxes and self-employment taxes. The budgeting calculator can help influencers to set aside enough money each month to cover these expenses.

- Invest in your business. Influencers can use the budgeting calculator to plan for investments in their business, such as new equipment, hiring new team members, or running paid advertising campaigns.

4 Tips For Budgeting Effectively

By using a financial calculator for budgeting, influencers can ensure that their business is profitable and on track to achieve their financial goals.

Furthermore, I’m sharing four additional tips for influencers on how to budget effectively. The more information you equip yourself with, the more successful your influencer business will be.

- Create a separate bank account for your business. For instance, by setting up individual accounts for your business will help keep personal finances separate instead of putting them into the same account.

- Set up automatic transfers. It’s best to do automatic transfers from your business account to your personal account to cover monthly living expenses. This will help you to avoid overspending your business income.

- Pay yourself a salary from your business account. This will help you to treat your influencer business as a real business and build a sustainable income stream.

- Have a financial advisor review your budget regularly. A financial advisor can help you to make sure that your budget is realistic and that you are on track to achieve your financial goals.

By following these tips, influencers can use a financial calculator for budgeting to plan out their monthly and year-over-year budgets and ensure that their business brings in a profit. For more influencer marketing and finance tips, visit www.LuvlyLongLocks.com.